Welcome to the enhanced AFG Home Loans Retro/Link internet banking. We think you’re going to love the improvements we’ve made!

You can use the same login details on your new Internet Banking but if you need help or you’ve misplaced your password, please contact our Client Services team on 1800 629 948 or email clientservices@afghomeloans.com.au.

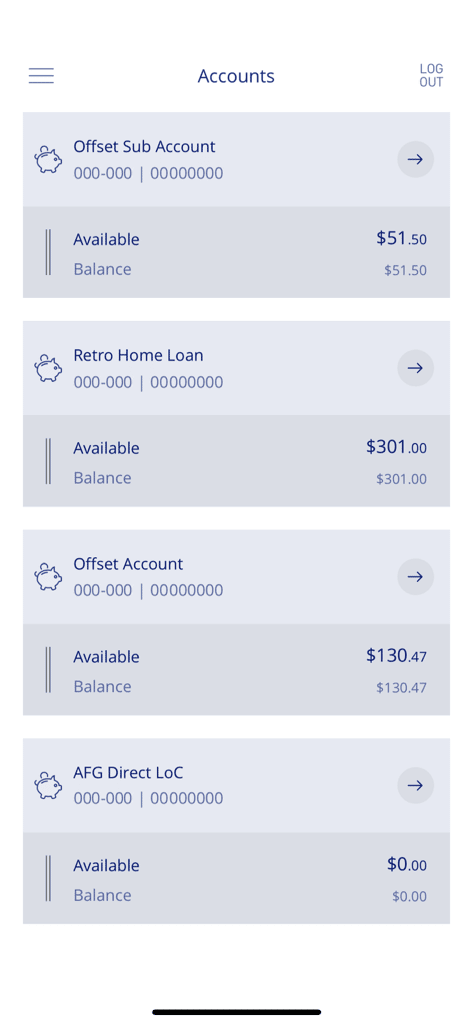

The AFG Home Loans Retro mobile app brings you a range of easy to use features and tools to help simplify the management of your loan.

Download the AFG Home Loans Retro mobile app at the links below.

What are the minimum requirements in order to use the app?

AFG Home Loans Pty Ltd is part of the ASX listed Australian Finance Group Ltd (AFG), one of Australia’s leading mortgage broking firms for almost a quarter of a century.

The information provided is a short summary and is not everything you need to know to select a product and features that are appropriate for your needs and requirements. All information is subject to change without notice. Terms and conditions and lending criteria may apply. Fees and charges may be varied or introduced in the future.

AFG Home Loans Pty Ltd | ACN 153 255 559 | Australian Credit Licence 411913

Buying your first home is exciting, but it’s a big step to take and one that comes with many questions and decisions.

Situations change, perhaps you’ve changed jobs, a new addition to the family? Maybe you would just like a better rate?

Research and having the right people to help you are the keys when investing in property.

Whether you’re looking to upsize, downsize, relocate, or buy that dream holiday home.

Building your own house can be a wonderful experience – but it can also be expensive.

The classic home loan with modern features.

Flexible loans for borrowers looking for solutions outside the box.

Tailored loans to support diverse needs.

A versatile home loan with no ongoing fees.

Simple competitive home loans with all the essentials.

Tailor your finance with a versatile range of loan options.

A finance solution for those who may not meet standard criteria.